BeaconLogic E³

Fully Automated Trading Strategy

BeaconLogic™ is the only company offering turn key trading strategies for the eMini Indices: eMini S&P, eMini DOW, eMini NASDAQ and eMini Russell.

- This automated strategy has been over 25 years in the making. It’s a Reactionary Price Action Volume method that takes advantage of immediate fluctuations and momentum turns in price movement in a growing number of Futures markets. Currently it is being applied to the eMini Indices but will later grow to take advantage of all available Futures markets.

- Unlike nearly all currently available strategies, we supply not only the algorithm but the actual trading environments you will use on a weekly basis to run inside NinjaTrader. You are required to do NO calculations, NO optimizations and NO testing to determine what markets or time frames to trade. Everything is supplied for you.

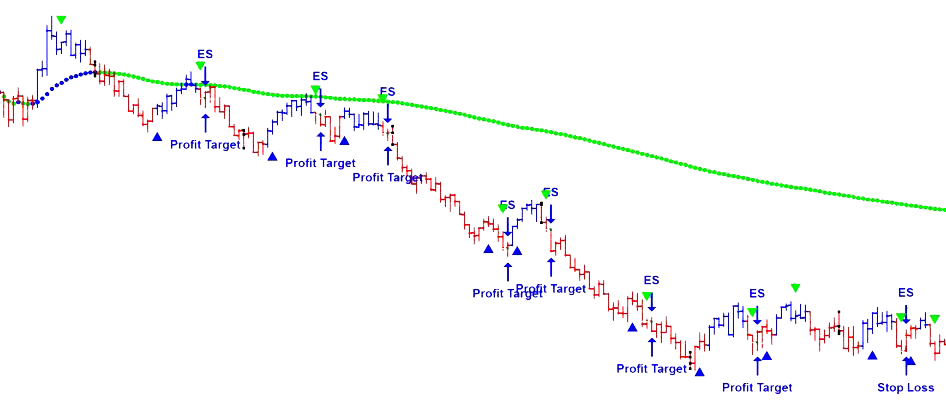

- We reoptimize all trading environments on a weekly basis to take advantage of on-the-fly market conditions in order to react quickly and profit from these trading environments in the safest manner possible. The strategy utilizes the efficient use of; profit targets, fine-tuned & tight stop losses and limit orders to trade these environments as safely as possible.

- Lastly, the strategy runs on your own leased co-located servers in Chicago to insure the cleanest and fastest fills.

- You get 2 weeks free to test this wonderful strategy. Then the strategy leases for $500 monthly which allows you to run all available trading environments and to trade up to an average of 20 contracts per trading environment: eMini S&P, eMini NASDAQ, eMini Russell and eMini DOW.

This strategy runs on the NinjaTrader’s Lifetime License as well. Email us at: wschamp@beaconlogic.com for more information.